The Surge of Gold Prices Amidst Geopolitical Turmoil: A Strategic Analysis

By News 24 Media, Business Analyst

Introduction

In the ever-shifting landscape of global affairs, gold has emerged as a steadfast beacon for investors seeking stability and security. As geopolitical tensions escalate in the Middle East and the Russia-Ukraine conflict intensifies, the allure of this precious metal has reached new heights. In this article, we delve into the factors driving the surge in gold prices, explore historical patterns, and provide strategic insights for investors.

The Perfect Storm: Factors Boosting Gold Prices

1. Geopolitical Instability

The ongoing conflict in the Middle East and the Russia-Ukraine crisis have created an environment of uncertainty. Investors, wary of geopolitical risks, flock to gold as a safe haven. The metal’s intrinsic value and historical resilience make it an attractive choice during times of turmoil.

2. Anticipation of Interest Rate Cuts

The United States is poised for interest rate adjustments, with some experts predicting multiple cuts within the year. Lower interest rates tend to enhance the appeal of non-yielding assets like gold. Investors seek refuge in gold as an alternative to traditional interest-bearing investments.

3. Persistent Inflation

Inflation erodes the purchasing power of fiat currency. As central banks grapple with rising inflation, gold becomes an attractive store of value. Its tangible nature provides financial security when paper currency falters.

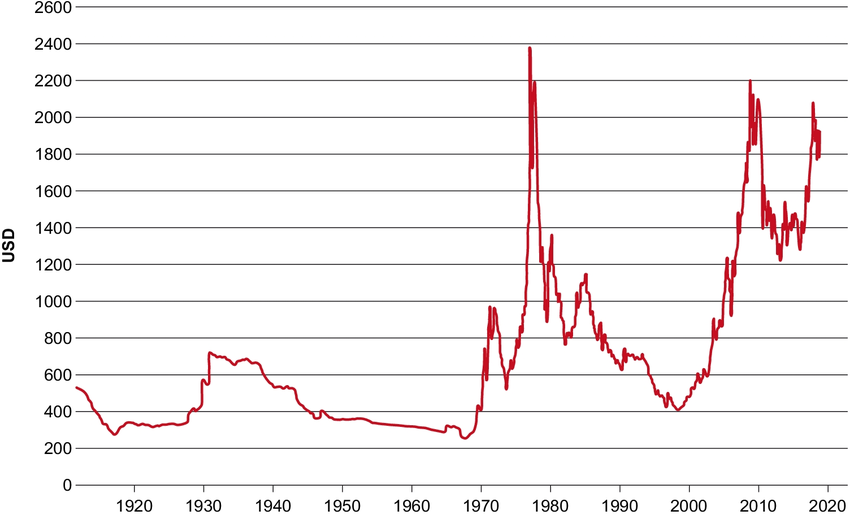

Certainly! Let’s delve into the historical trajectory of gold prices, examining key milestones and patterns over time.

Gold Price History: A Glittering Journey

1. Gold Price.org

The website GoldPrice.org offers an extensive collection of historical gold price data. Here are some highlights:

- Spot Gold Prices in U.S. Dollars (USD):

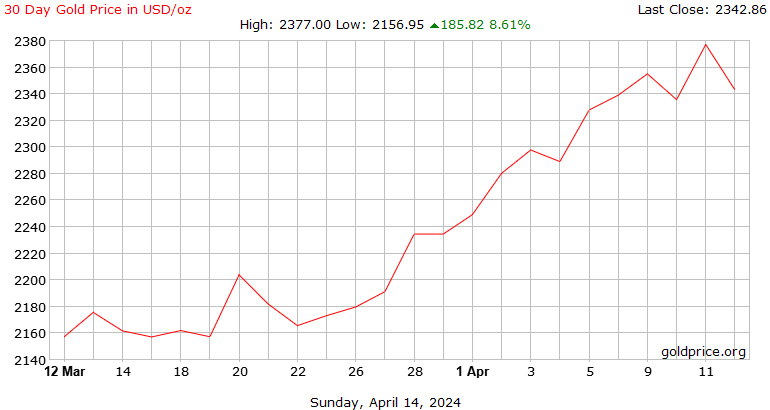

- Over the past 40 years, gold has experienced significant fluctuations.As of the most recent data, the price stands at $2,395.16 per ounce.The chart below illustrates the journey:

- Inflation-Adjusted Gold Price:

- Adjusting for inflation, gold’s value remains a crucial benchmark.

- The chart below shows the inflation-adjusted gold price using the 1980 Consumer Price Index (CPI) formula:

2. MacroTrends

Another valuable resource is MacroTrends. Their interactive chart provides real (inflation-adjusted) gold prices per ounce dating back to 1915. The series is deflated using the headline Consumer Price Index (CPI).

!Gold Price Chart – 100-Year Historical

3. World Gold Council

The World Gold Council has offered comprehensive data on gold prices across various timeframes (daily, weekly, monthly, and annually) since 1978. You can explore prices in different currencies, including trading, producer, and consumer currencies.

4. Investing.com

For those interested in futures data, Investing.com provides historical information on Gold Futures. You can view closing prices, open, high, low, and percentage changes for various date ranges.

Gold Price Movement: A Closer Look

Over the past few weeks, gold prices have followed a consistent upward trajectory:

| Date | Pure Gold (24K) | Standard Gold (22K) |

|---|---|---|

| 4 April, 2024 | INR 6,142 | INR 5,630 |

| 3 April, 2024 | INR 6,164 | INR 5,650 |

| 2 April, 2024 | INR 6,109 | INR 5,600 |

| 1 April, 2024 | INR 6,033 | INR 5,530 |

Investment Strategies: Buy, Hold, or Sell?

1. Buy and Diversify

- Gold ETFs and Sovereign Gold Bonds: Consider gold-backed financial instruments. These provide exposure to gold without the hassle of physical purchase and storage.

2. Hold as a Hedge

- Gold Mining Stocks: The profitability of gold mining stocks tends to increase as gold prices rise. However, these stocks are more volatile than the metal itself.

3. Strategic Selling

- Gold Mutual Funds: These funds hold shares of mining company stocks and even physical metal. Evaluate your risk tolerance and consider selling when prices peak.

Conclusion

As the world grapples with geopolitical uncertainties, gold remains a steadfast companion for investors. Whether you choose to buy, hold, or sell, remember that timing the market perfectly is challenging. Stay informed, diversify your portfolio, and let gold be your anchor in turbulent seas.

Disclaimer: The views expressed in this article are solely those of the author and do not constitute financial advice. Always consult with a professional financial advisor before making investment decisions.

More Interesting Articles

Technical Textile Market: A Futuristic Outlook

Breaking Trust: The Royal Bank of Canada’s Chief Financial Officer Dismissal

The Dawn of Artificial Intelligence: Opera Browser Transforming Our Web

Sodium Nickel Chloride Battery: A Sustainable Alternative to Lithium

America’s Dollar Tree Stores: A Struggle for Survival

Telegram web: Judge in Spain Orders Nationwide Suspension of Telegram

8 Business Trends to Get Ready for in 2024

Instagram Down Faces Global Outage: Users Disconnected and Disappointed

Generative AI and the Evolution of the Best Search Engine – Google Search

Amazon sale’s Big Spring Sale 2024: Everything You Need to Know!

Reddit IPO Values Social Media Firm at $6.4 Billion in Share Sale

Generative AI and the Evolution of the Best Search Engine – Google Search

Top 7 Remote Work Software for Individuals and Businesses

Lamborghini Huracan Tecnica: A Fusion of Excellence.

Apple AI News- Apple’s Latest AI Advancement Revolutionizes the

Fintech Companies Ecosystem- India and ADB Ink $23 Million Loan Pact to Enhance

SpaceX Starship: A Galactic Leap in Space Exploration

Major Factors Risk Aviation Fuel Cost Derailing Net-Zero Sustainability Goal

Revolutionizing Wind Energy: The World’s Largest Plane Set to Supercharge

Electric Vehicle Technology Companies Euphoria Fades: Automakers Reassess

Market Research Analyst- Key Lessons for Businesses From Google’s Conversational

Digital divide-Satellite Firms Form Unlikely Alliances: The Dawn of Seamless Multi-

Sony Corporation news – Innovative Leap into NFTs with ‘Super Fungible Tokens’

Discover more from News 24 Media

Subscribe to get the latest posts sent to your email.