Reliance Power Emerges Debt-Free: Anil Ambani’s Remarkable Turnaround

Background and Highs and Lows:

Anil Ambani once celebrated for his business acumen, faced a dramatic downfall amidst mounting debts worth crores. His journey with Reliance Power began when he expanded his business portfolio by entering the power sector. In 2007, Anil’s total wealth exceeded Rs. 4 lakh crores, highlighting his considerable success. However, challenges arose when he had to purchase costly natural gas for his power plants, leading to setbacks.

The Resurgence of Reliance Power: Debt-Free Status

Fast forward to today, Reliance Power has achieved a major milestone by becoming debt-free on a standalone basis. Between December 2023 and March 2024, the company diligently repaid all outstanding debts (around Rs 800 crore) to financial institutions such as IDBI Bank, ICICI Bank, Axis Bank, and DBS. This transformation reflects enhanced operational competence and strategic decisions.

Reliance Power’s remarkable turnaround can be attributed to several key factors:

- Debt Reduction Efforts: Reliance Power has made concentrated efforts to reduce its debt burden. Recently, the company settled dues with ICICI Bank, Axis Bank, and DBS Bank, leaving only a working capital loan on its books from IDBI Bank.

- Capital Infusion and Investment Proposal: Reliance Commercial Finance’s capital infusion and investment proposal have provided hope for the company’s revival. These moves signal confidence in Reliance Power’s prospects.

- Positive Industry Outlook: Amid abundant opportunities in the power sector, Reliance Power’s strategic efforts are aligned with growth initiatives. The company’s focus on improving business and financial viability has resonated positively with investors.

Investor Recommendations:

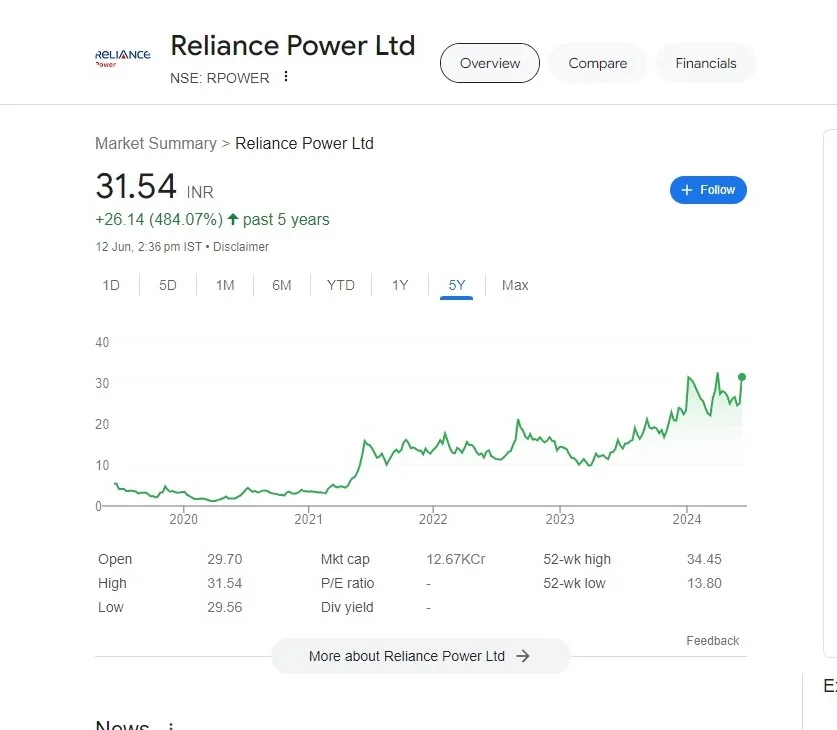

- Positive Momentum: Reliance Power shares have surged approximately 22% in one week, catching investors’ attention. The stock recently gave a fresh breakout at ₹28 per share and may touch ₹36 soon.

- Energy Policy Impact: The newly formed Modi 3.0 cabinet’s energy policy agenda could benefit Reliance Power. The company’s debt-free status positions it well for growth.

- Target Levels: Analysts anticipate further gains. New investors can consider buying the stock with a stop loss at ₹24 and targets of ₹32 and ₹36. Existing shareholders can also hold, aiming for the same levels while maintaining a stop loss at ₹24.

Remember, investment decisions should be made after thorough research and consultation with certified experts. Anil Ambani’s rollercoaster ride seems to be taking off once again, and Reliance Power’s old glory might just be around the corner!

More Interesting Articles

Decoding Warren Buffett’s Exit from Apple: Essential Lessons for Savvy Investors

Foreign-exchange reserves of India Reach Record High Under PM Modi’s Leadership

The Rise and Fall of Revenge Spending/ Shopping: Unmasking Post-Pandemic Consumer Behavior

NVIDIA Stock Announces Record Financial Results for Q4 and Fiscal 2024

Cryptocurrency Trading in India Faces Uncertain Times: SEBI’s Recommendations and RBI’s Concerns

Cooling Champions: The Top 10 Inverter Air Conditioners for Energy-Savvy Homes

iPhone Photography: Capturing the Ethereal Beauty of the Northern Lights!

IBM’s Bold Step: Acquiring HashiCorp to Redefine the Cloud Industry Landscape

TikTok Ban – US House Passes Bill That Could Ban TikTok

Walmarts Near Me -Retail Revolution: Self-Checkout Takes Center Stage

Shop laptops on sale – Top 5 Laptops of 2024 Your Ultimate Guide

The Iran Israel War: Navigating Economic Turbulence

Which is Better – Comparing AI Chatbots: ChatGPT Plus, Google Gemini, and Copilot

Harnessing Sunlight for Green Fuel: A Breakthrough in CO₂-to-Fuel Conversion

The Impact of Ongoing Military Engagements on US Military Personnel: A Call for De-

The Impact of Artificial Intelligence App on the Working Class: Navigating the AI Revolution

Dive into the Intriguing Lives of the Top 10 Wealthiest Women Billionaires on Earth

Discover more from News 24 Media

Subscribe to get the latest posts sent to your email.