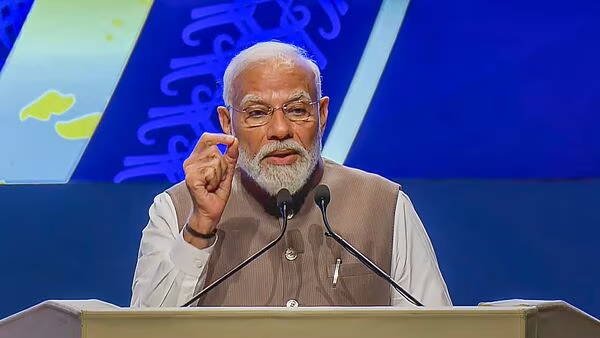

Foreign-exchange reserves of India Reach Record High Under PM Modi’s Leadership

Introduction

Foreign-exchange reserves of India have reached an all-time high, surpassing the $648.7 billion mark as of May 17, 2024, according to the Reserve Bank of India (RBI). This remarkable achievement comes after a consistent upward trend in reserves over several weeks. Let’s delve into the factors behind this surge, its implications for India’s economy, and the prospects for the future.

Growth of Foreign-exchange reserves of India

During the half-year period under review, India’s reserves increased from $576.98 billion at the end of March 2021 to $635.36 billion by the end of September 2021. This growth is significant and reflects India’s robust economic performance and prudent monetary policies.

Sources of Accretion for Foreign-exchange Reserves of India

Several factors contribute to the accumulation of Foreign-exchange reserves of India:

- Trade Surplus: India’s trade balance has improved due to increased exports and reduced imports. A trade surplus means more foreign currency inflows, which add to the reserves.

- Foreign Direct Investment (FDI): India has attracted substantial FDI inflows, especially in sectors like technology, manufacturing, and services. These investments bolster the reserves.

- Foreign Portfolio Investments (FPI): Foreign investors have shown confidence in India’s markets, leading to higher FPI inflows. These investments contribute to the reserves.

- Stable Currency: The RBI’s efforts to maintain a stable exchange rate have helped prevent excessive volatility. A stable currency encourages foreign investors and supports reserves.

High foreign exchange reserves can bring both benefits and risks to a country’s economy. Let’s explore the potential risks associated with maintaining substantial reserves:

- Currency Risk: While reserves provide stability, they are often held in major currencies like the US dollar and Euro. If these currencies depreciate significantly, it can lead to valuation losses on the reserves. Central banks need to manage this risk carefully.

- Opportunity Cost: Holding large reserves means tying up significant capital that could be invested elsewhere. The opportunity cost arises from not using these funds for productive investments or domestic development.

- Market Risk: Reserves invested in bonds and treasury bills are subject to market fluctuations. Changes in interest rates or credit ratings can impact the value of these assets.

- Liquidity Risk: While reserves provide a buffer, sudden liquidity needs (such as during a financial crisis) may require selling these assets. Illiquid markets can pose challenges.

- External Dependence: Relying heavily on reserves can create dependency on external factors (like global economic conditions). A sudden reversal in capital flows could affect reserves.

- Sterilization Costs: Accumulating reserves often involves intervention in the foreign exchange market. Sterilization costs arise from managing excess liquidity created by these interventions.

- Perpetuating Global Imbalances: Some argue that excessive reserves perpetuate global imbalances by contributing to trade surpluses and deficits.

Prospects and Implications of Foreign-exchange Reserves of India

The high level of Foreign-exchange reserves of India has several implications for India:

- Economic Stability: Ample reserves act as a buffer during economic downturns, ensuring stability and confidence in the financial system.

- Currency Management: With substantial reserves, India can intervene in the foreign exchange market to manage currency fluctuations effectively.

- Reduced External Vulnerability: High reserves reduce India’s dependence on external borrowing, making it less vulnerable to global shocks.

- Investment Opportunities: The surplus reserves can be invested strategically to generate returns, contributing to overall economic growth.

India’s Position in the International Market-Foreign-exchange reserves of India

India’s robust reserves and high Foreign-exchange reserves of India enhance its standing in the global economy:

- Trade Negotiations: A strong reserve position gives India leverage in trade negotiations, allowing it to protect its interests effectively.

- Investment Destination: Investors view countries with healthy reserves as attractive investment destinations. India’s reserves signal stability and growth potential.

- Bilateral Relations: Reserves impact India’s diplomatic relations. A financially stable nation is better positioned to engage with other countries.

Future Outlook

Looking ahead, India must continue its prudent reserve management. The RBI’s focus on safety and liquidity ensures that reserves remain a reliable shield against external shocks. Maintaining an adequate reserve level will be crucial for sustained development as India’s economy grows.

In conclusion, the record-high foreign exchange reserves of India under PM Modi’s leadership reflect sound economic policies and resilience. These reserves not only safeguard against uncertainties but also position India as a formidable player in the global arena.

Disclaimer: The information provided here is based on available data and analysis. Readers are encouraged to consult official reports and experts for a comprehensive understanding.

More Interesting Articles

The Rise and Fall of Revenge Spending/ Shopping: Unmasking Post-Pandemic Consumer Behavior

NVIDIA Stock Announces Record Financial Results for Q4 and Fiscal 2024

Cryptocurrency Trading in India Faces Uncertain Times: SEBI’s Recommendations and RBI’s Concerns

Cooling Champions: The Top 10 Inverter Air Conditioners for Energy-Savvy Homes

iPhone Photography: Capturing the Ethereal Beauty of the Northern Lights!

IBM’s Bold Step: Acquiring HashiCorp to Redefine the Cloud Industry Landscape

TikTok Ban – US House Passes Bill That Could Ban TikTok

Walmarts Near Me -Retail Revolution: Self-Checkout Takes Center Stage

Shop laptops on sale – Top 5 Laptops of 2024 Your Ultimate Guide

The Iran Israel War: Navigating Economic Turbulence

Which is Better – Comparing AI Chatbots: ChatGPT Plus, Google Gemini, and Copilot

Harnessing Sunlight for Green Fuel: A Breakthrough in CO₂-to-Fuel Conversion

The Impact of Ongoing Military Engagements on US Military Personnel: A Call for De-

The Impact of Artificial Intelligence App on the Working Class: Navigating the AI Revolution

Dive into the Intriguing Lives of the Top 10 Wealthiest Women Billionaires on Earth

Discover more from News 24 Media

Subscribe to get the latest posts sent to your email.