Top 10 Best Performing Equity-Oriented Mutual Funds in July 2024

Investors always look for the best mutual funds to maximize their returns. As of July 2024, several equity-oriented mutual funds have stood out due to their exceptional performance. This article delves into the top 10 best-performing equity mutual funds, providing detailed insights into their strategies, performance metrics, and what makes them attractive to investors.

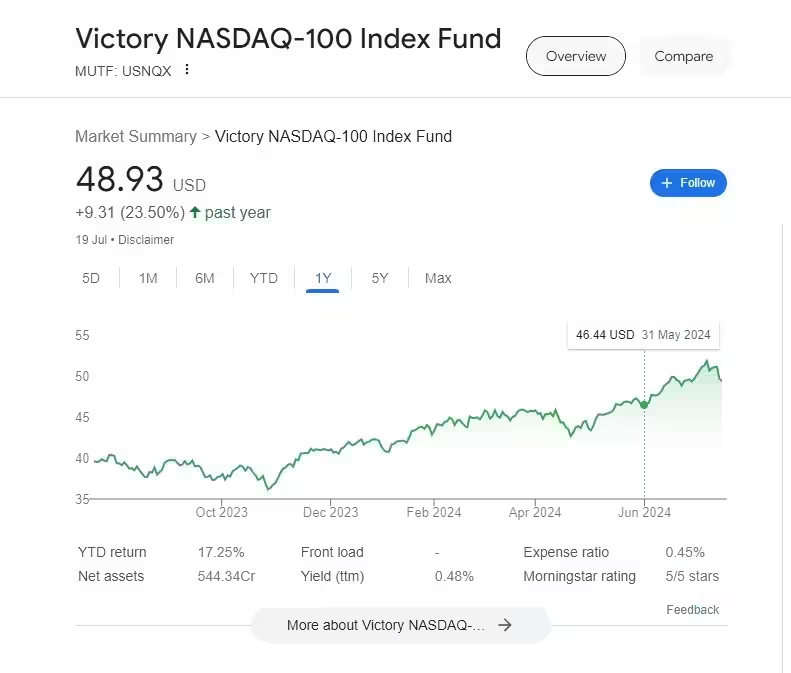

1. Victory NASDAQ-100 Index Fund (USNQX)

- 5-Year Return: 21.1%

- Expense Ratio: 0.20%

- Fund Overview: This fund tracks the NASDAQ-100 Index, focusing on the largest non-financial companies listed on the NASDAQ stock market. Tech giants like Apple, Microsoft, and Amazon drive its strong performance.

2. Vanguard Growth Index Fund (VIGRX)

- 5-Year Return: 18.61%

- Expense Ratio: 0.17%

- Fund Overview: VIGRX aims to track the performance of the CRSP US Large Cap Growth Index. It invests in large-cap growth stocks, making it a solid choice for investors seeking growth opportunities.

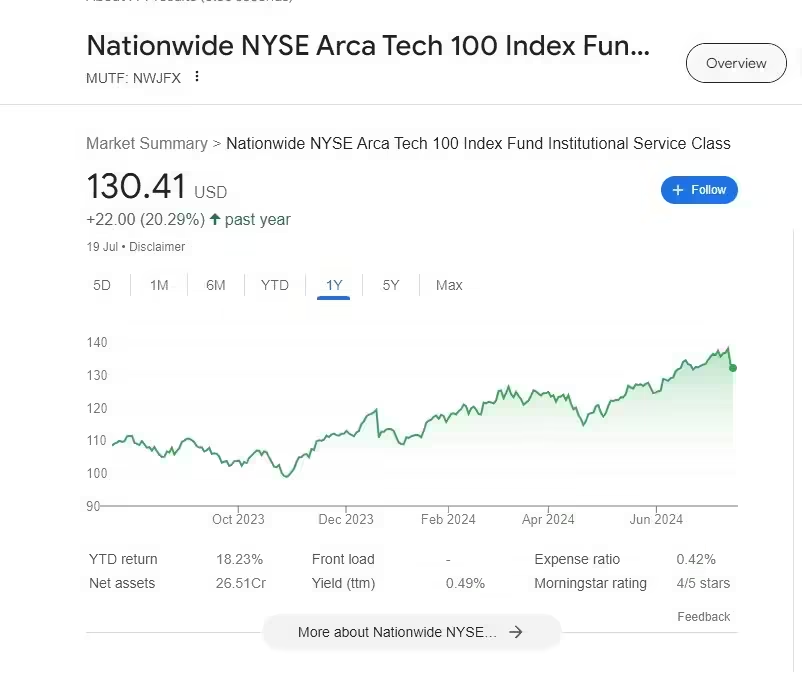

3. Nationwide NYSE Arca Tech 100 Index Fund (NWJFX)

- 5-Year Return: 16.13%

- Expense Ratio: 0.45%

- Fund Overview: This fund focuses on technology companies listed on the NYSE Arca Tech 100 Index. Its portfolio includes high-performing tech stocks, contributing to its robust returns.

4. Vanguard Growth & Income Fund (VQNPX)

- 5-Year Return: 15.08%

- Expense Ratio: 0.33%

- Fund Overview: VQNPX seeks to provide a balance of growth and income by investing in large-cap stocks that offer both capital appreciation and dividend income.

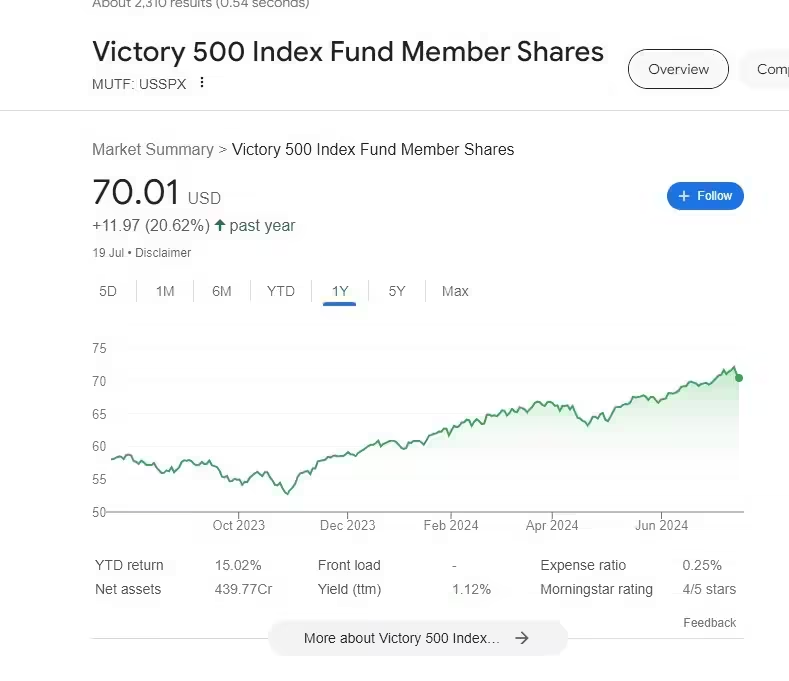

5. Victory 500 Index Fund (USSPX)

- 5-Year Return: 14.94%

- Expense Ratio: 0.18%

- Fund Overview: This fund tracks the S&P 500 Index, providing exposure to 500 of the largest U.S. companies. Its diversified portfolio makes it a stable choice for long-term investors.

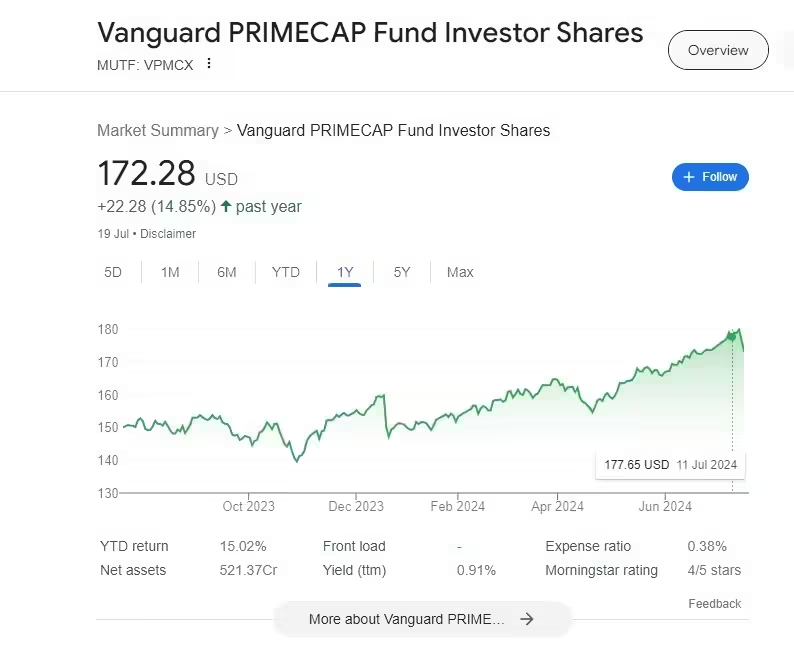

6. Vanguard PRIMECAP Fund (VPMCX)

- 5-Year Return: 14.88%

- Expense Ratio: 0.38%

- Fund Overview: VPMCX focuses on companies with strong growth potential. Its active management strategy has consistently delivered impressive returns.

7. MoA Equity Index mutual fund (MAEIX)

- 5-Year Return: 14.76%

- Expense Ratio: 0.25%

- Fund Overview: This fund aims to replicate the performance of the MoA Equity Index, which includes a mix of large and mid-cap stocks. Its diversified approach has yielded solid returns.

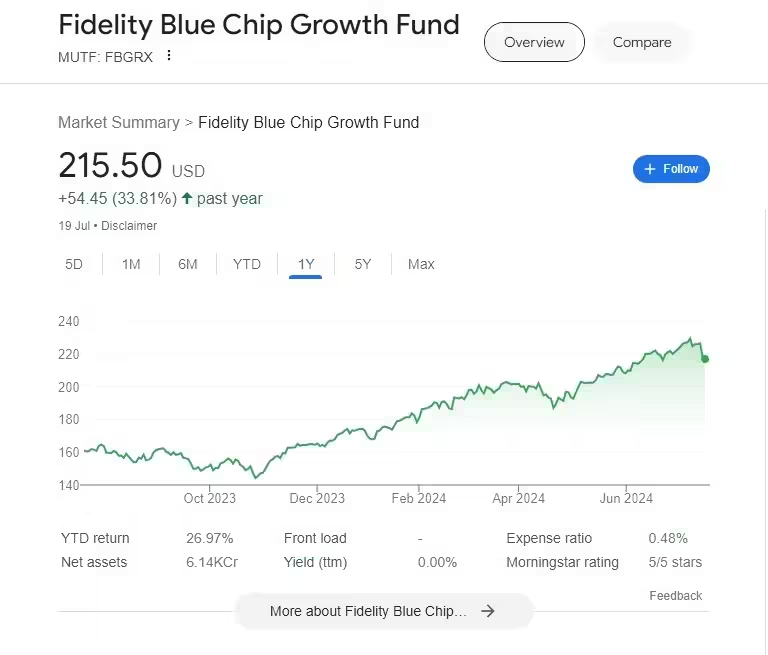

8. Fidelity Blue Chip Growth Fund (FBGRX)

- 5-Year Return: 14.50%

- Expense Ratio: 0.79%

- Fund Overview: FBGRX invests in blue-chip companies with strong growth prospects. Its focus on high-quality stocks has made it a favorite among growth-oriented investors.

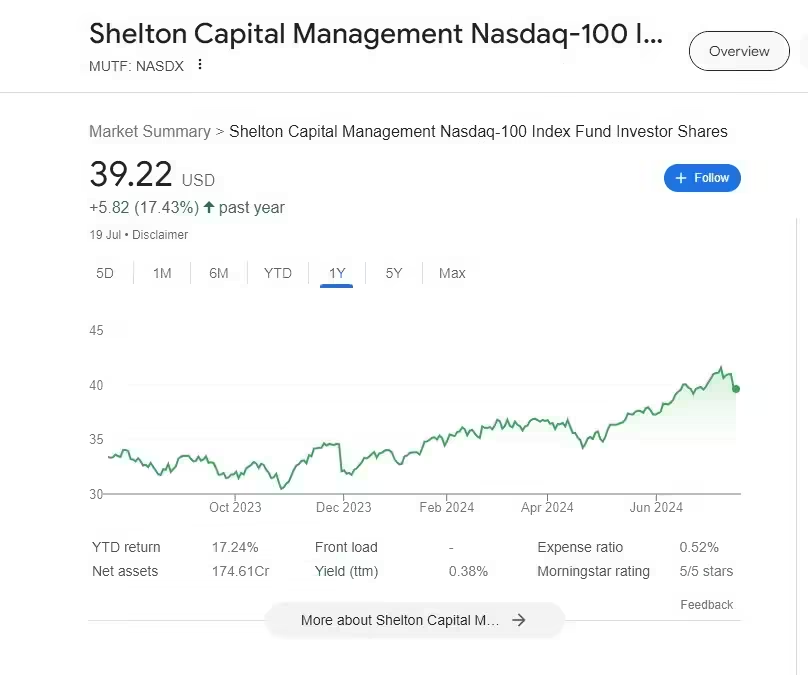

9. Shelton Nasdaq-100 Index mutual fund (NASDX)

- 5-Year Return: 14.30%

- Expense Ratio: 0.50%

- Fund Overview: Similar to USNQX, this fund tracks the NASDAQ-100 Index. Its emphasis on tech stocks has driven its impressive performance.

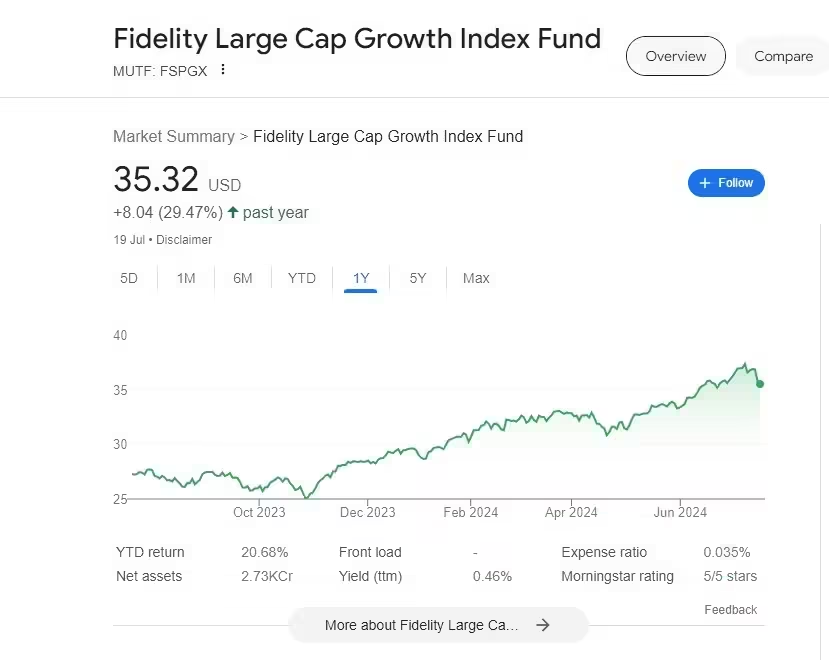

10. Fidelity Large Cap Growth Index mutual fund (FSPGX)

- 5-Year Return: 14.10%

- Expense Ratio: 0.04%

- Fund Overview: FSPGX aims to provide investment results corresponding to the total return of large-cap growth stocks in the U.S. Its low expense ratio and strong returns make it an attractive option.

Key Takeaways for Investors

- Diversification: These mutual funds offer a diversified portfolio, reducing risk while providing exposure to high-growth sectors.

- Expense Ratios: Lower expense ratios can significantly impact net returns. Funds like FSPGX and VIGRX offer competitive expense ratios.

- Performance: Historical performance is a crucial indicator, but investors should also consider the fund’s strategy and market conditions.

Investing in mutual funds requires careful consideration of various factors, including performance, expense ratios, and the fund’s investment strategy. The funds listed above have demonstrated strong performance and are well-positioned to continue delivering solid returns. As always, investors should conduct their research and consider their financial goals before making investment decisions.

More Interesting Articles

CrowdStrike and Microsoft Disruption Sparks Global Chaos: A Major Incident Unfolds

European Union to Strongly Warn Elon Musk’s X for Failing to Combat Dangerous Content

Paramount Global to Merge with Skydance Media in a Game-Changing $28 Billion Deal

AI Ascendancy: Nvidia’s Market Cap Milestone Marks New Era of Tech Dominance

Microsoft’s Satya Nadella and BlackRock’s Larry Fink Lead Tech Titans at the G-7 Summit in Italy

Reliance Power Emerges Debt-Free: Anil Ambani’s Remarkable Turnaround

Decoding Warren Buffett’s Exit from Apple: Essential Lessons for Savvy Investors

Foreign-exchange reserves of India Reach Record High Under PM Modi’s Leadership

The Rise and Fall of Revenge Spending/ Shopping: Unmasking Post-Pandemic Consumer Behavior

NVIDIA Stock Announces Record Financial Results for Q4 and Fiscal 2024

Cryptocurrency Trading in India Faces Uncertain Times: SEBI’s Recommendations and RBI’s Concerns

Cooling Champions: The Top 10 Inverter Air Conditioners for Energy-Savvy Homes

iPhone Photography: Capturing the Ethereal Beauty of the Northern Lights!

IBM’s Bold Step: Acquiring HashiCorp to Redefine the Cloud Industry Landscape

TikTok Ban – US House Passes Bill That Could Ban TikTok

Walmarts Near Me -Retail Revolution: Self-Checkout Takes Center Stage

Shop laptops on sale – Top 5 Laptops of 2024 Your Ultimate Guide

The Iran Israel War: Navigating Economic Turbulence

Which is Better – Comparing AI Chatbots: ChatGPT Plus, Google Gemini, and Copilot

Harnessing Sunlight for Green Fuel: A Breakthrough in CO₂-to-Fuel Conversion

The Impact of Ongoing Military Engagements on US Military Personnel: A Call for De-

The Impact of Artificial Intelligence App on the Working Class: Navigating the AI Revolution

Dive into the Intriguing Lives of the Top 10 Wealthiest Women Billionaires on Earth

Discover more from News 24 Media

Subscribe to get the latest posts sent to your email.